Welcome to Embedded Finance Review. I make embedded finance more accessible with the weekly newsletter, biweekly podcasts, and events.

This newsletter went out to {{active_subscriber_count}} subscribers. If you want to support my work, you can upgrade to premium or become a sponsor.

Hi {{first name|embedded finance friend}}

When you are reading this, I will (hopefully) be up in the air on my flight to Dubai. I am looking forward to some warmer temperatures, sun, and spending time with our family and friends over there. I intend to write next week's edition as normal, so no disruption is expected. And if any of my readers are in the UAE this week or next, let me know :-)

Job Board: Another non-German banking-as-a-service provider is looking to hire a Germany-based business development manager. Curious to learn more? Hit reply!

Sponsorship: As mentioned, I am working towards including embedded finance companies in the sponsor section below. Finalising the details around this is taking a bit longer than expected; thus, I decided, why shouldn’t I be the first sponsor? :-)

And now let’s dive in 👇

Advertisment:

👋 Hi there! I am not only your friendly newsletter writer and podcast host but also an independent embedded finance advisor. Are you preparing, launching, or growing your embedded finance offering and need some external support? Check my profile here and reply to set up an intro chat.

ServiceTitan’s IPO filing reveals its embedded finance stack

What happened: The US vertical SaaS provider ServiceTitan has filed for an IPO and is expected to go public soon (SEC). The company offers a cloud-based platform for trade industries and covers all of their workflows end-to-end. A plumber can use ServiceTitan as its only software solution, which covers anything from the usual CRM features to marketing, scheduling of a technician, and, of course, fintech products such as payment and financing.

My comment: ServiceTitan has the potential to become the new poster child for embedded finance. Companies like Shopify or Toast are still way ahead, but a successful IPO from ServiceTitan could prove that embedded finance is not limited to a few specific industries. To narrow down on their fintech offering, ServiceTitan’s core fintech feature is, of course, payments acceptance: the plumber business can accept payments from customers online or offline, and the data is directly available in the software for further business activities. Additionally, ServiceTitan offers a financing product for their customer’s customer. For example, when the plumber informs their customer that just changing the toilet won’t help and bigger changes are necessary, the plumber can actively suggest financing products to pay for the bill. According to ServiceTitan, those businesses that offer financing products see a 12% higher close rate and a 13% higher ticket size.

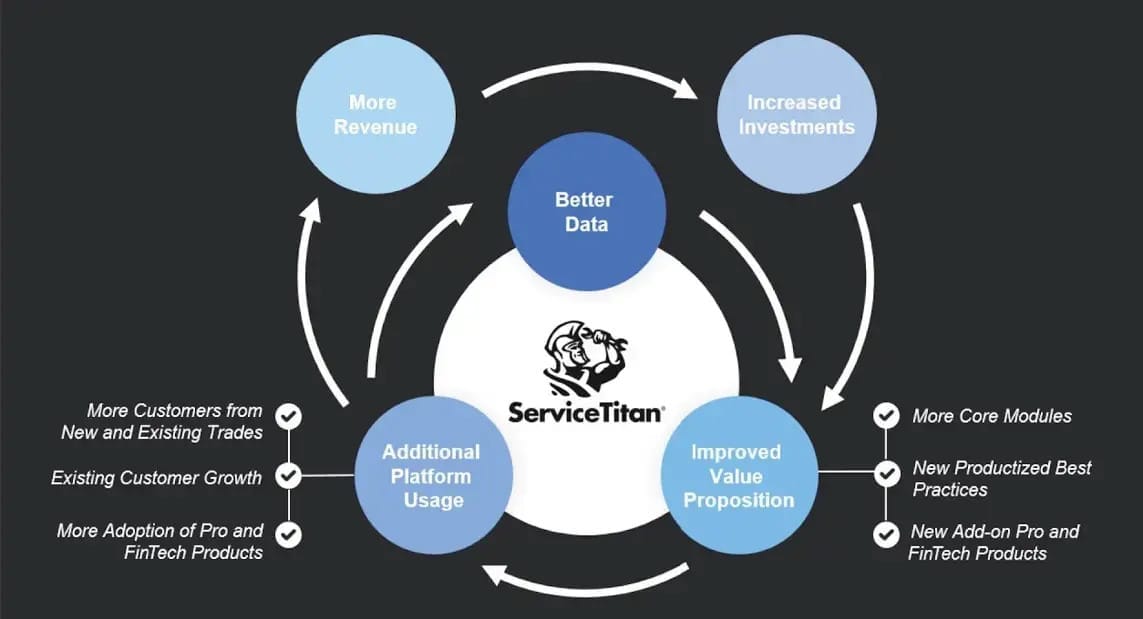

The magic of embedded finance is not just in the pure numbers. As you can see in the image above, which is part of the official S-1 filing, the usage of fintech products is part of ServiceTitan’s flywheel. Both the payment and consumer financing features increase revenue directly but also improve the customer experience and value generated.

Currently, ServiceTitan is only operating in the US and Canada. We are seeing a few local competitors in Europe already, but would ServiceTitan also have a chance in the European market?

Modulr acquires Nook and will launch an accounts payable solution

What happened: British banking-as-a-service provider Modulr has acquired accounts payable provider Nook (TechFundingNews). Nook targets businesses and accountants, and to put it simply, it offers a badge transfer solution. Instead of authorizing outgoing transfers separately, the business owner or accountant connects their bookkeeping tool with Nook and can start and finish the payment run in seconds.

My comment: Currently, Nook partners with Currency Cloud for its e-money accounts. These accounts need to be funded by the businesses or accountants before the outgoing transfers can be made. With the acquisition, Currency Cloud will probably be replaced by the Modulr offering, and the solution will be made available to existing and new Modulr customers.

The e-money accounts (Modulr’s core offering) are the basis for such an offering, but often they don’t solve problems by themselves. What is often required is another layer of features and functionality tailored to specific customer segments. From my point of view, the acquisition makes a lot of sense for Modulr, and it’s another move away from the pure banking-as-a-service offering to a complete business flow solution.

Does B2C embedded finance need new loyalty providers?

What happened: Kalder describes itself as an embedded loyalty provider and has just announced their $10.5 million funding (Finextra). With Kalder, a customer can join their favorite brand’s loyalty program. They just need to link their credit or debit card and will receive cashback for purchases at partner retailers. The brand benefits from tracking and insights, with payouts made for each transaction.

My comment: Kalder is not the first provider of this kind, and also here in Europe we have card-linked cashback solution providers. But the announcement and the new Forbes’ piece about US wallet and loyalty provider Ansa (Forbes) made me think. Embedded finance is never easy, but we see so many more B2B companies acing this game (see ServiceTitan above). B2C companies often have a much harder time in achieving this. I always say an embedded finance solution needs to achieve “1+1=3” (My EF Guide), basically, creating magical value when adding fintech into a non-fintech offering. This is complex for B2C, and very often the place to create magical value is around loyalty. Providers like Kalder enable brands to offer loyalty without necessarily entering the fintech game. But I do wonder if next-gen loyalty providers are required to push B2C embedded finance product offerings. What do you think?

Short stories

- Lessons learnt from implementing ApplePay by somebody who has actually done it (LinkedIn).

- US banking-as-a-service provider Alviere launches cash-to-cash cross-border remittance services (The Paypers).

- GTreasury has announced its partnership with PNC Bank in order to introduce embedded banking (The Paypers).