Hi {{first name|embedded finance friend}}

Summer is here! Well, it’s still raining in Berlin, but the number of Embedded Finance news announcements has come down significantly.

Since I was expecting this, my newsletter will also enter “summer mode”. But don’t worry, you will still get a weekly newsletter. For the next few weeks, I will be aggregating all relevant Embedded Finance stories of the first seven months of 2025 for you.

Since this will be too much for one mailing, I decided to split the news into the different financial products. As you hopefully know, the term Embedded Finance consist of the five sub-categories: Banking, Lending, Payment, Investment and Insurance.

Thus, this newsletter structure for the next few weeks will look like this:

August 5th → Banking (today!)

August 12th → Lending

August 19th → Payment

August 26th → Investment & Insurance

And of course, if a new major announcement arrives earlier than that, then I will incorporate it or adjust the structure.

PS: This mailing is longer than usual. If you are using Gmail, this email might get clipped.

What are the biggest mistakes when building Embedded Finance products? Join us on Friday August 29th at 11am (CEST) to learn, share and discuss. We will be joined by Fintech executitve and newsletter subscriber Christian von Hammel-Bonten to help us walk through the biggest mistakes. And after each mistake, we will take a break and discuss with the audience.

This edition covers

How did you like this type of edition? Please let me know via the feedback at the end of this mailing.

And now let’s dive in 👇

Advertisement:

Are you building something new in Embedded Finance? Feel free to reach out for a free intro call, and maybe I (or somebody from my network) can help. More info here

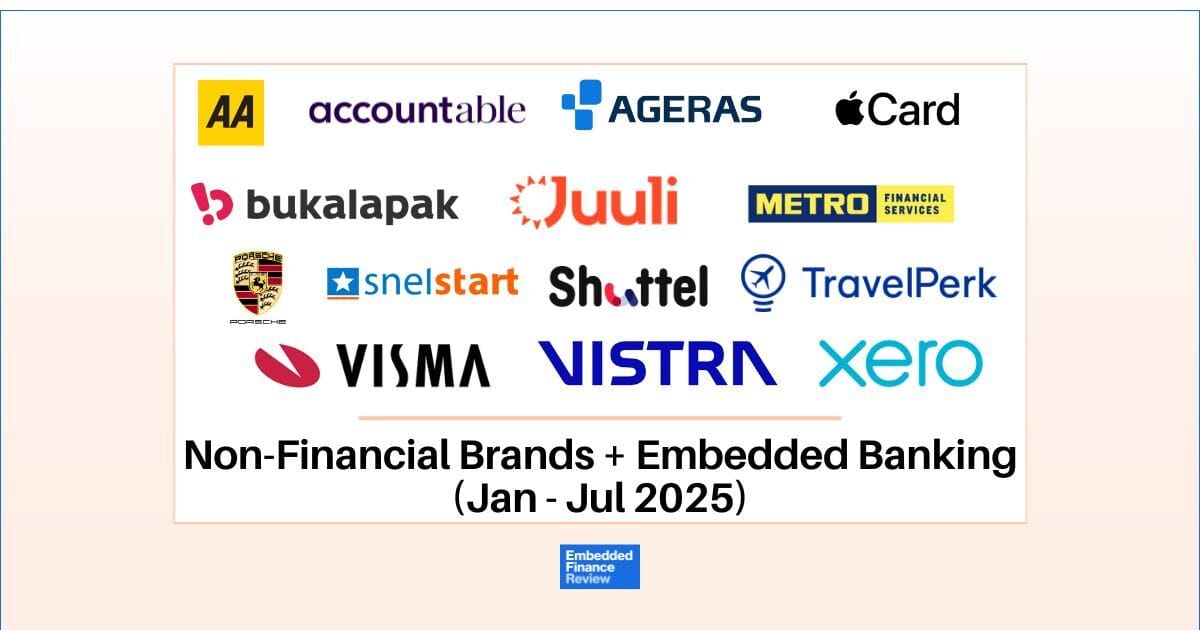

Top Non-Financial Brand Stories (Jan-Jul 2025)

My comment: Embedded Finance combines non-financial with financial products. The non-financial brands are the front-end players. Their core products aren't financial services, but they can be combined with them. This could be any non-financial brand, even companies like Lego, DHL, or Total. But unlike what many think, this isn't purely driven by the non-financial company's brand, but by how well the financial product is embedded. While those three companies are universally known, they might struggle to connect their core product to banking. For others, it's much easier.

Not surprisingly, digital accounting for SME and freelancers was the most significant driving force of Embedded Finance in 2025 so far. Accounting and banking are so intertwined, but historically, it was the user's job to combine the two worlds. Digital accounting providers are now launching banking products right, left and centre. It's hard to believe that in a few years there will be any digital accounting provider left that hasn't embedded a banking product in some way.

But of course, there was not only positive news from non-financial brands in Embedded Banking and in 2025, we have seen two major setbacks.