Hi Embedded Finance Friend

This is the first mailing from my new tech setup - I hope the delivery rate doesn't drop and all of my subscribers get this mailing 🤞

Before we dive in:

- I hope the migration of subscribers went correctly, and only active subscribers are receiving this email. That said, if you have (recently) unsubscribed and still received this message: apologies, and please use the link in the footer to unsubscribe.

- Also, you can now manage the emails you receive from me: weekly, monthly and podcasting mailings. If a weekly newsletter cadence is too much for you, you can switch to a monthly newsletter (the first one will go out on December 1st; click "Manage my subscription" in the footer and then "Manage").

And my final reminder: we are hosting our Embedded Finance Review Event in Berlin tomorrow (Wednesday)! Actually, we were 'sold out', but I just increased the number of available tickets, so grab one while they are available. See you tomorrow!

And now let’s dive in 👇

Are you new to Embedded Finance? Check out my resources, including slide decks and longer articles, on my website.

Allegro and PKO Bank Polski Launch Strategic Partnership Including Embedded Merchant Lending

Polish e-commerce giant Allegro and PKO Bank Polski launched two financial products within Allegro's marketplace:

- Allegro Klik is an open banking payment solution connecting PKO Bank Polski customers' accounts directly to Allegro, with payment authorisation on Allegro's platform and cashback rewards.

- The second product offers Allegro's 160,000+ merchants embedded business loans up to PLN 500,000 with one-click applications and next-day funding.

Both services launch in 2025, with the bank targeting 1 million new customers and PLN 1.5 billion in merchant lending over three years. This partnership signals a shift in traditional banks' distribution strategy, with PKO Bank Polski's CEO emphasising the need to "go where customers are" rather than bringing them to the bank.

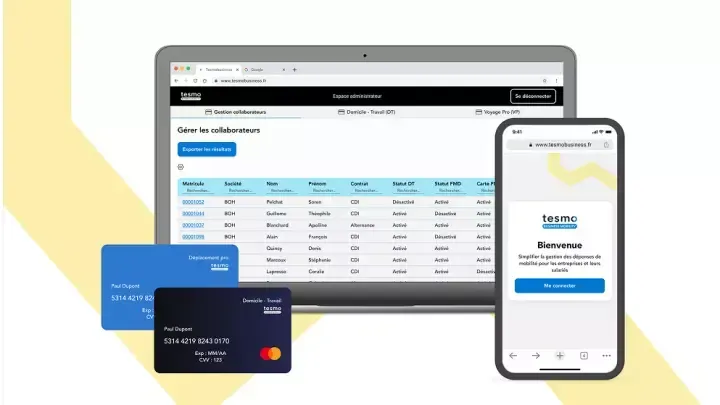

French Rail Operator SNCF's Digital Unit Launches Expense Management Platform with Embedded Cards

SNCF Connect & Tech, the digital subsidiary of French rail operator SNCF, launched Tesmo Business Mobility, a SaaS platform combining expense management software with embedded physical and virtual payment cards issued through French BaaS provider Swan. The platform centralizes employee commuting and business travel expenses, with cards that managers can activate for specific trips, eliminating expense reports and out-of-pocket spending. It includes a simulator helping employees identify mobility subsidies they're eligible for, and companies get complete visibility into travel spending with automatic receipt capture. SNCF tested the platform internally with its 1,300 employees before launching externally, and it's positioned as a white-label, customizable solution for SMEs and mid-sized companies. The partnership validates Swan's enterprise capabilities as a VC-backed BaaS provider working with large state-owned enterprises.

Viber Pay Switches Infrastructure Provider to Paynetics

Rakuten Viber switched its Viber Pay service from Rapyd to Paynetics as its infrastructure provider, migrating existing users across seven European markets (Slovenia, Slovakia, Lithuania, Estonia, Greece, Cyprus, and Germany) and bringing Visa virtual debit cards to all users. Viber Pay lets users send money to friends and family instantly within the messaging app with no fees, maintain a wallet with an IBAN, and now access a Visa virtual debit card for online shopping. The service has attracted over 1 million wallet openings since launching in 2022. Viber's product roadmap includes bill splitting in group chats, utility bill payments, and integration with Apple Pay and Google Pay. The partnership positions Paynetics to expand beyond fintech customers into non-financial platforms, considering embedded finance moves, leveraging Viber's existing user base and messaging infrastructure.

In other Embedded Finance news

- Porsche presented its new co-branded credit card in partnership with Visa (LinkedIn; more details about the card previously covered by me here).

- Finnish issuer processor Enfuce (also one of the companies enabling Porsche with its Porsche Card) expanded to Brazil, its first market in Latin America (Enfuce).

- Pipe, the US-based embedded lending provider, has laid off about half its staff. According to the company, "Pipe’s business is strong and growing rapidly, but it needs to focus more on profitability and operating efficiency" (LinkedIn).

- Snap Finance launched a virtual card that offers a more convenient solution for customers seeking flexible payment options. The new proposition makes point-of-sale finance more accessible and manageable, offering customers instant loan access, greater flexibility in how they spend and pay, and complete visibility through the Snap Wallet mobile app (Finextra).

- Visa and Mastercard have reportedly inched closer to a settlement with US retailers that would see both payment companies reduce the fees they charge merchants (The Paypers).

- Booking.com went live with Revolut Pay, enabling its customers to pay directly with their Revolut balance. Also, non-Revolut customers can use it with any debit/credit card (LinkedIn).

Thank you for reading. I hope you enjoyed this edition.

My newsletter, podcast, and event activities are free, but I need your support to continue. Please share Embedded Finance Review with your friends and coworkers, and let me know your feedback.

And if you need help understanding, building, or launching an embedded finance product, visit my website and get in touch.

Best wishes from Berlin,

Lars Markull (LinkedIn)