Welcome to Embedded Finance Review, where I make embedded finance more accessible with weekly newsletters, biweekly podcasts, and events. This newsletter went out to {{active_subscriber_count}} subscribers. If you want to support my work, you can upgrade to premium or become a sponsor.

Hi {{first name|embedded finance friend}}

Welcome to this year’s Happy Birthday newsletter edition. Well, it's not the birthday of Embedded Finance Review, but of the author behind it 🥳

Since leaving my last employee role a few years ago, my birthdays pretty much look like this: a bit of deep work, a good amount of time for reflection, no work calls, lunch with my wife at a nice restaurant and cutting some cake with my daughter in the afternoon :-)

And a lot more important: If you are a reader from Germany and are eligible to vote, please take some time on Sunday to vote in the upcoming election. I have not decided yet which party I will vote for, but obviously, it will be a party with democratic values. I hope you will, too.

This edition covers

- Our fifth event in Frankfurt: The role of banks (Recap)

- Accountable launches embedded banking offering

- WeTransfer launches an embedded payment product - cash-on-delivery in the digital world

- The missing embedded finance puzzle piece? Ageras acquires Storebuddy

- Link section, incl. Froda, Pipe and BaaS deep dive articles

And now let’s dive in 👇

Our fifth event in Frankfurt: The role of banks (Recap)

Last week, we hosted our fifth Embedded Finance Review Event in Frankfurt. We want to thank our sponsors, Banxware and Thought Machine, for their support and for making our first Frankfurt event a reality.

Also, a big thank you to everybody who joined us. I was happy to see a packed room during the presentations and networking. This edition focused on the role of banks in embedded finance, and we heard and discussed the perspectives of various players.

For a longer event recap, photos and slides, please click here.

Accountable launches embedded banking offering

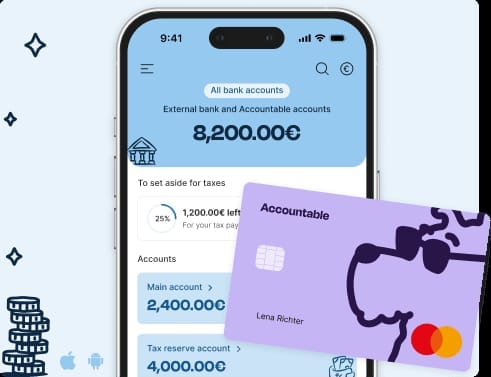

What happened: Accountable is a freelancer-focused accounting tool that operates predominantly in the Belgian and German markets. Via a mobile or web app, users can write and send invoices to their clients, manage their expenses, and get support in answering various tax-related questions - either via an AI-powered chatbot or by connecting to an actual tax advisor. Last week, the company announced the launch of its own embedded banking offering in Germany (LinkedIn announcement).

My comment: I am an Accountable user and have beta-tested the embedded banking product for the past few weeks. Accountable has partnered with French banking-as-a-service provider Swan, and the offering consists of a German IBAN and a debit card (virtual and physical). It is a pretty basic banking offering, you could say.

What is unique and nicely tailored for a freelancer-focused banking use case is that I have two separate IBAN accounts: one primary account and the second one is the tax reserve account. It is one of the biggest traps for freelancers to spend money that is in their bank account but technically does not belong to them (e.g., income tax or VAT). Accountable helps users recognize how much of their bank account balance needs to be transferred to the financial authority at a later point and moves this to the tax reserve account.

Previously, I used a Wise bank account for my freelance activities and connected it to the Accountable app via open banking. The tax calculation features are identical for an open banking connected account and Accountable’s embedded banking offering. But there are some reasons why the embedded solution might become the more popular choice:

- Faster sync between invoicing and banking

- No need to re-connect the external account after 180 days

- Accountable’s incentives for some users to switch (2% cashback)

- It is the easiest choice if you don’t have a separate bank account for your freelancer activities yet

- Perhaps the launch of new features specifically for Accountable’s embedded banking users (?)

WeTransfer launches an embedded payment product - cash-on-delivery in the digital world

This may be old news, but I have never seen it. The popular file sender provider WeTransfer offers an embedded payment solution (WeTransfer). The tool is commonly used to send larger files, making it perfect for designers or other creative people to send their work to clients. However, there is a common challenge in such a transaction, especially if the two parties have never met and connected over the Internet: the order for sending the artwork and payment.

Either party is taking a risk when sending the artwork or payment first, allowing the other side to delay or not do their part of the contract. WeTransfer aims to tackle this with the embedded payment product, which allows the artist to send their artwork, but the client can only download it if they pay the requested amount. To put it more straightforward, cash on delivery in the digital world.

Similar to cash on delivery, there is still a chance for the artist to send different files (e.g., putting old books into the parcel instead of the agreed iPhone) and still get paid. However, I would assume this payment product was not designed to make it harder for fraudulent artists but to get real artists paid on time. We can probably all imagine that every artist at one point had to run behind a client multiple times to “remind” them of payments.

The WeTransfer payment product is in beta in the US and Canada. However, since WeTransfer partnered with Stripe, there should be no reason to expand it to other markets after the successful test phase.

And thanks to Meaghan for highlighting this product launch to me.

The missing embedded finance puzzle piece? Ageras acquires Storebuddy

What happened: The Danish company Ageras acquired storefront provider Storebuddy (Fintech Futures). I already covered Ageras in the past, which offers services and a marketplace focused on accounting and tax advisory. The company operates in six different European countries and took significant fintech steps with the acquisition of German freelancer neobank Kontist, the launch of an embedded banking offering in the Netherlands under their band Tellow, and the acquisition of French SME neobank Shine.

Storebuddy enables entrepreneurs and small businesses to keep their e-commerce shop and accounting in sync, which can be a nightmare if done separately.

My comment: Agera’s acquisition of Storebuddy may sound less of an embedded finance move than perhaps the acquisition of a fintech company like Kontist and Shine. However, if you know my embedded finance intro deck, you may remember that I like to say that an embedded finance product needs to achieve a 1+1=3 customer value proposition(check the deck for more details). To achieve such outcomes, embedded finance companies need to invest as much at the intersection of their fintech and non-fintech product offerings as they do in the fintech product itself. Storebuddy might not be a fintech product itself, but if integrated well, it might be the tool to drive more fintech product usage among Agera’s core customers.

Link section

- Scandinavian embedded lending provider Froda expands its partnership with neobank Lunar to Sweden. While this news is not purely embedded finance, Froda also works with non-financial brands and is getting more visibility thanks to the partnership with Lunar (Finextra).

- US Regions Bank announces Regions Embedded ERP Finance, enabling its clients to access financial accounts within their ERP platforms for better cash flow management (The Paypers).

- Embedded finance provider Pipe expands to Canada (Finextra).

- What BaaS companies learned the hard way in 2024 — and what’s coming next (Tearsheet).