Hi {{first name|embedded finance friend}}

There are quite a few updates from my side, so let’s start right away:

- Virtual event → Our second edition is scheduled for this Friday at 10am (CEST). With Fintech Investor Meera from 13books Capital, we will be discussing the impact of Fintech on other industries: Register here

- Curated intros → I have some ideas to add more community features to Embedded Finance Review. The first one is curated email intros, where I connect relevant subscribers (after both gave their opt-in). There are still some questions on my side, when and exactly how I will do this. That said, I figured I would first test the actual interest among my subscribers. Thus, if you’d like to give this a try, fill out this survey, and you will hear from me.

- Partner with me → I am currently discussing various partnership opportunities with several companies for Embedded Finance Review. It’s still early, and I’m unsure of the direction it may take, but if your company targets the Embedded Finance market and you’re keen to learn more, reach out to me.

- Job board → A global SaaS provider from my network is hiring a Senior Product Manager (remote) with a focus on Embedded Payments. Please ping me for more details.

This newsletter went out to {{active_subscriber_count}} subscribers.

And now let’s dive in 👇

Do you need help understanding, building or launching an Embedded Finance product? Reply to this email and let’s see if I can help (or know someone who can).

Dext Partners with Airwallex to Launch Embedded Payments Solution

What happened: The digital bookkeeping provider Dext has announced a strategic partnership with Airwallex to launch Dext Payments (Dext). Dext Payments will be launched later this year, offering a seamless, integrated payments solution within the Dext platform. This completes the accounts payable workflow, offering full automation from invoice upload through to payment.

My comment: Dext focuses strongly on receipt collection, automation, and expense management services. It is not an accounting tool itself, but it is connected to these providers and financial institutions. With such a pure focus on receipt collecting, the move into payments for accounts payable seems logical. However, it also removes this step from one of the underlying providers and transfers it to Dext. Will users prefer to make payments within Dext or stay with their existing workflow (depending on the setup, this could also involve Embedded Payments)? While it may not be a significant strategic shift at Dext, it will be interesting to see how the underlying providers react, as some of them have their own accounts payable solutions.

There are still some questions about the exact details of the Dext payment offering. The announcement doesn’t say if this will be powered by bank transfers or cards, both of which Airwallex could offer. Additionally, the announcement mentions the creation of local bank details and payment links for Dext’s customers; however, both features are for accounts receivable, not accounts payable. That said, we will get our answers with the launch of Dext Payments, and since the partnership is described as strategic, we might see the rollout of new features over time.

Pleo Launches Embedded Expense Management Platform for Banks and Fintech Companies

What happened: European expense management provider Pleo announced the launch of Pleo Embedded (LinkedIn). Pleo targets banks, fintech companies, and specialised software providers, enabling them to embed the entire Pleo product, not just the card.

My comment: We have seen different expense management providers expanding into the as-a-service segment. German Pliant, Swedish Mynt and Estonian Wallester have all started as pure expense management solutions, but have all expanded their offerings to include card-as-a-service and white-label solutions.

If I were to compare the different solutions, I would start by considering how much of the core product customers can or need to embed. Pleo’s approach appears to be that customers embed more of the core product than just the card (others focus solely on the card, and in some cases, users can even log into both services: the expense management provider and the company that embedded them). I think all these approaches can make sense; what matters is who the ideal customer is and what their technical resources, commitment to the solution and product strategy are. In a way, Pleo’s move also means additional competition for stand-alone banking-as-a-service providers, who would love to sell to the same fintech companies and specialised software providers but require them to build the frontend completely themselves.

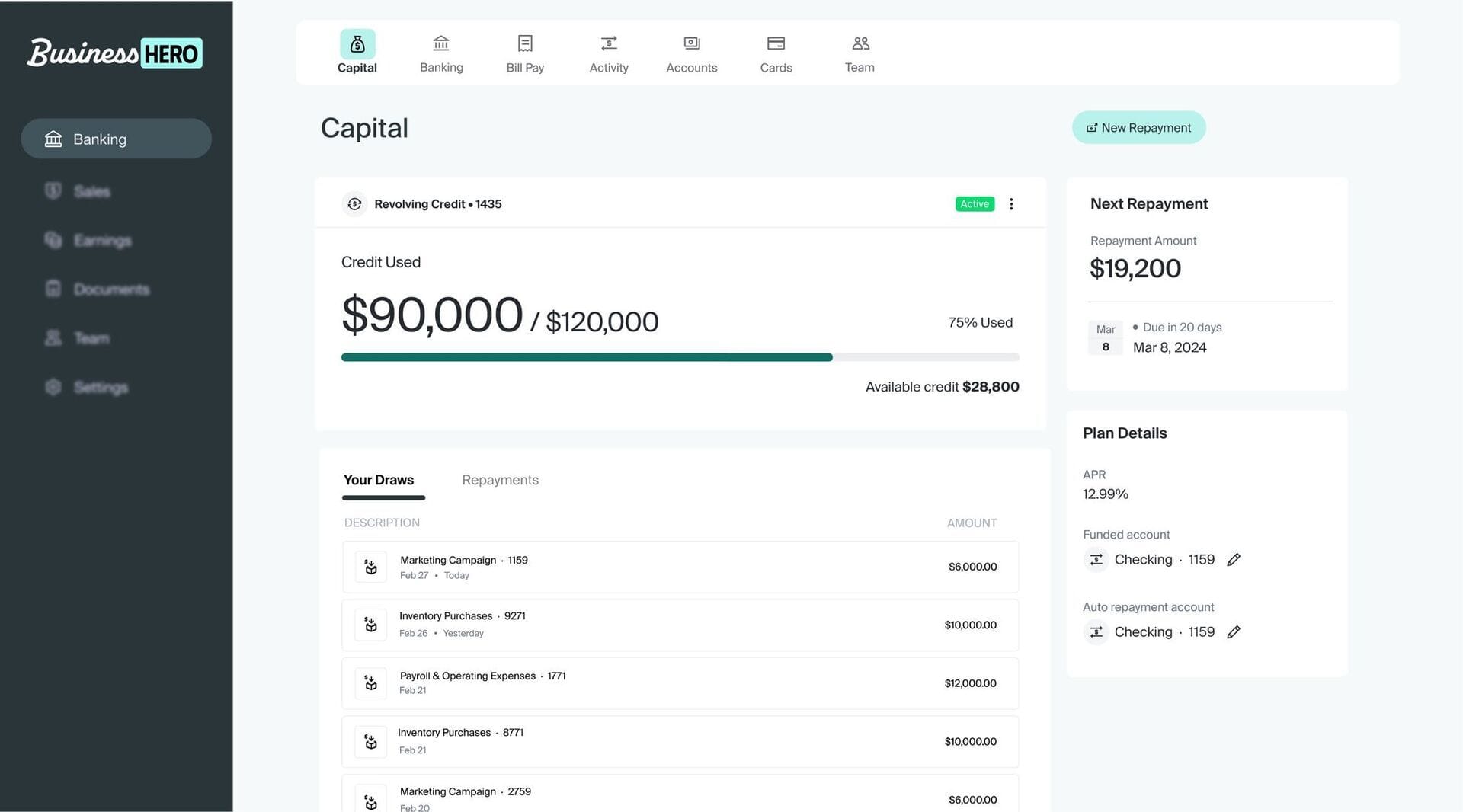

Unit Expands Beyond Banking to Launch Embedded Lending for SaaS Providers

What happened: The US infrastructure provider Unit has significantly extended its product offering, including a lending offering (Unit). Unit has a strong focus on SaaS providers. It works with companies such as Honeybook (a SaaS solution for service-based businesses) and Homebase (an all-in-one solution for hourly teams). Previously, the company offered only card and banking-related services.

My comment: The announcement mentions various new features, but the most interesting one for me is the lending feature. A standalone infrastructure provider that offers banking and lending is not that common. In Europe, providers like Solaris, Vodeno and Griffin either have had or might offer a combination of this offering, but none of them have a strong focus on SaaS like Unit does.

I view this announcement from two different perspectives: on the one hand, I completely get it. The US SaaS market is massive, and the pain points Unit describes are accurate. So, being the all-in-one provider for all things Embedded Finance (not just Banking) for SaaS companies makes a lot of sense. On the other hand, companies often roll out Embedded Finance features one after the other, and not in all cases is there a strong connection between banking and lending, for example. During this journey, companies will gain knowledge, expertise, and capabilities as they integrate different providers and launch fintech products. Therefore, I wonder if bigger SaaS companies are more inclined to select their specialised providers for each financial product and invest time and resources in integrating multiple best-in-class providers. What do you think?

In other Embedded Finance news

🎙️ Podcast corner

- Adyen launched a new Embedded Finance podcast. Competition for my podcast? Not at all, let’s educate the market together! Three episodes are published; the third one was my favourite so far. Yours? (Spotify)

- 11FS’ newest podcast features guests from Marqeta, Spendesk, and Liberis. It raises the question: Can embedded finance be a fix-all for SMBs? (11FS)

🗞️ News

- Clear Junction has extended access to its named virtual IBAN services to licensed virtual asset service providers (VASPs), a functionality previously only available to banks and electronic money institutions. (Finextra)

- Digital debt collection services provider Debtist continues its growth trajectory by opening an office in the United Kingdom. The company offers its services directly to businesses and also via an ‘Embedded’ solution. (Finextra)

- Hakuna enables chainsaw maker STIHL to bundle service packages into B2B equipment leases and sales. (Hakuna)

- US infrastructure provider Treasury Prime pivoted from selling Embedded Banking to non-financial brands to enable banks to offer Embedded Finance products. And it seems the pivot pays off. (LinkedIn)

- Galileo, the B2B financial services arm of SoFi Technologies, is emerging as a key engine of growth in the rapidly expanding embedded finance market. (Yahoo Finance)

Thank you for reading. I hope you enjoyed this edition.

My newsletter, podcast, and event activities are free, but I need your support to continue. Please share Embedded Finance Review with your friends and coworkers, and let me know your feedback (links above).

And if you need help understanding, building, or launching an embedded finance product, visit my website and get in touch with me.

Best wishes from Berlin,

Lars Markull (LinkedIn)