404

The page you requested doesn't exist

We could not locate the page: /newsletter/2023-08-29

Try one of the featured posts or search the archive below.

Featured Posts

The Complete Embedded Finance Primer: Strategies, Examples, and Revenue Models

Learn what Embedded Finance truly means, how it differs from Fintech, and the 5 key financial products that can be embedded. Discover revenue models, implementation strategies, and what makes Embedded Finance products successful for non-financial brands.

Previous newsletters

The Complex World of Travel Payments with Eric-Jan Krausch of 1-CP

Discover the complex world of travel industry payments with Eric-Jan Krausch, founder of 1-CP. Learn how virtual cards, payment structures, and embedded finance innovations transform the travel sector's B2B landscape. Explore the challenges of legacy systems and the opportunities in modernizing travel payment infrastructure.

Qonto Launches Embedded Banking Offering

Explore Qonto's new embedded banking solution competing with traditional BaaS providers, plus access my comprehensive 4500+ word Embedded Finance Primer covering strategies, examples, and revenue models. Stay updated on the latest embedded finance partnerships and upcoming industry events.

The Complete Embedded Finance Primer: Strategies, Examples, and Revenue Models

Learn what Embedded Finance truly means, how it differs from Fintech, and the 5 key financial products that can be embedded. Discover revenue models, implementation strategies, and what makes Embedded Finance products successful for non-financial brands.

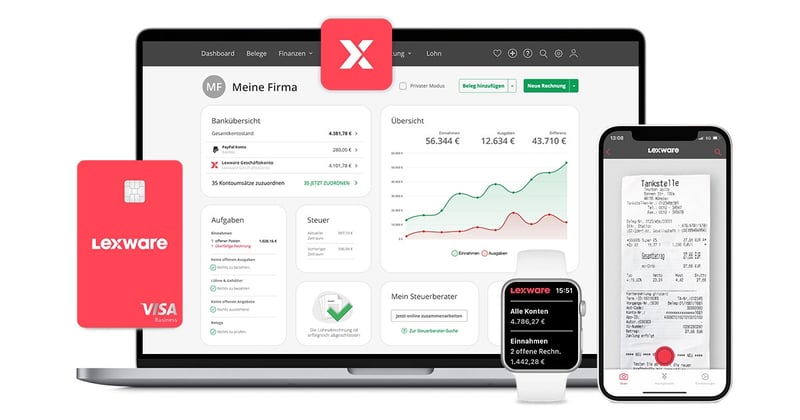

Dutch Bookkeeping Tool Launches Banking + $33M BaaS Funding in MENA

Discover the latest embedded finance trends: Snelstart partners with Flow and Adyen for bookkeeping banking integration, NymCard raises $33M Series B in MENA, plus upcoming fintech events in London, Berlin, Helsinki, and Frankfurt. Expert analysis on embedded finance solutions for real business problems

Jobs To Be Done - Why Embedded Finance Must Solve Real Problems with Paul Staples

Paul Staples, former HSBC and ClearBank exec, reveals why embedded finance success requires solving real customer problems, not just brand power. Key insights on fintech evolution and banking adaptation strategies.

Reinventing Banking for Property Managers - with Enrique Sanchez from Aareon Spain

Discover how Aareon Spain revolutionizes property management finance with an innovative embedded banking solution. Streamline operations, reduce costs, and gain intelligent financial insights for homeowners associations.

Vistra's Global Banking Launch & Marqeta's Strategic Acquisition

Discover how Vistra partners with Airwallex to launch global banking services, Marqeta strengthens its European presence through TransactPay acquisition, and Travelnest optimizes payment flows for property owners. Plus, upcoming embedded finance events in Berlin and London.

NatWest Boxed reveals first client: Embedded Finance for 14m British consumers

Discover how AA's partnership with NatWest Boxed will bring savings accounts and fast personal loans to 14 million UK members while Indonesian e-commerce giant Bukalapak exits its banking venture with Standard Chartered.

Embedded Car Financing in Saudi Arabia with Ali Tabbalat from EmFlex

Discover how Ali Tabbalat is revolutionizing car financing in Saudi Arabia through embedded finance. Learn about EmFlex's innovative approach to connecting banks with consumers, the $10B Saudi auto financing market, and how open banking transforms financial services in the MENA region.

Accountable and WeTransfer launch new embedded finance products

Accountable launches a banking product for freelancers in Germany; WeTransfer's new embedded payment product is a digital cash-on-delivery solution, and Ageras' strategic Storebuddy acquisition completes its embedded finance puzzle.