Welcome to Embedded Finance Review, where I make embedded finance more accessible with weekly newsletters, biweekly podcasts, and events. This newsletter went out to {{active_subscriber_count}} subscribers. If you want to support my work, you can upgrade to premium or become a sponsor.

Hi {{first name|embedded finance friend}}

Welcome to a slightly shorter version of this newsletter than usual. I had blocked Monday afternoon to write this newsletter, but I had to take care of a sick child instead. 🙃 Thus, I had to reduce the number of longer stories, but I still covered all relevant news in the link section.

I was also initially planning to make a few more changes to this newsletter (design and content), but I will push that out by a week or two. The event calendar is still included but is now at the end of this mailing.

PS: As of Monday night, my subscriber count sits at 1,499. Maybe you want to help me to cross the 1,500 mark? Share the link below with coworkers and friends 😊

And now, let’s dive in 👇

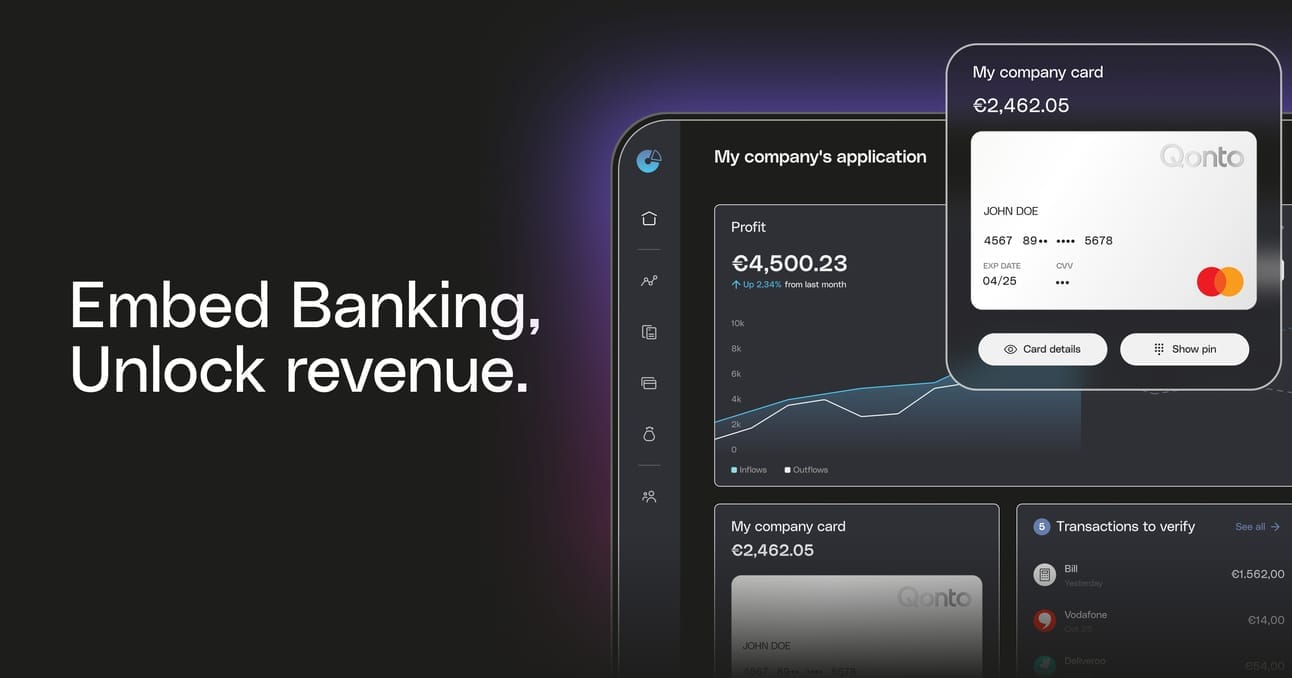

Qonto launches embedded banking offering

What happened: The French SME neobank has launched an embedded banking offering. There is no official announcement (yet), but the offering is described on Qonto’s website (Qonto). The website also features several French businesses, mostly in the accounting and legal space, as the first partners. The service is available in eight countries: France, Germany, Italy, Spain, Portugal, the Netherlands, Belgium, and Austria.

My comment: This is a very interesting move, as Qonto now competes directly with various European banking-as-a-service providers. It seems that Qonto wants to position itself as a simpler option than the traditional banking-as-a-service providers (e.g., highlighting an integration in two to four weeks) that takes care of much of the overhead (e.g., Qonto customer support). And this is the crucial point: when a partner embeds Qonto, its customers get a normal Qonto payment account, which they can access via the partner’s or Qonto’s website. This is totally different to a “traditional” banking-as-a-service provider’s offering, where only the partner can offer these banking features.

This brings us to the question: Is this directly competing with the standard banking-as-a-service provider market or serving a different segment? Personally, I say that’s somewhere in between. I do see a lot of brands who would not consider a Qonto Embed integration. Firstly, it is a potential risk for them to lose the customer to Qonto, and secondly, their vision of offering financial services might be bigger than just offloading this in parts to a neobank. On the other hand, I do see a lot of brands that have considered an embedded banking integration for the longest time but did not feel comfortable taking the risk of working with a traditional banking-as-a-service provider. Maybe they are better served with Qonto Embed.

I have a feeling we will hear more from Qonto about this offering soon, so I will make sure to cover it.

The Complete Embedded Finance Primer: Strategies, Examples, and Revenue Models

I finally published my Embedded Finance Primer. In this 4500+ word article, I answer some of the questions I encounter daily:

- How do you define Embedded Finance?

- Which financial products can be embedded?

- Has Embedded Finance reached a tipping point?

- What makes an Embedded Finance product great?

- Which companies are building Embedded Finance products?

- How can you make money with Embedded Finance?

- How can you build an Embedded Finance product?

I would love to hear your feedback: What is unclear? What is missing?

In other Embedded Finance news

- Mastercard partners with Dutch Bizcuit to facilitate access to embedded financial services for banks (The Paypers; check also my podcast with Bizcuit founder Hessel Kuik)

- SBI receives regulatory approval for the takeover of Solaris (Finextra)

- Lloyds partners Taulia for virtual cards (PYMNTS)

- Upvest appoints former Investec & Starling exec as UK general manager (Finextra)

- Walmart partners JPMorgan to bring embedded finance to marketplace sellers [Finextra]

- Embedded payments startup enza from Dubai raises $6.75 million (Finextra)

Event Calendar

- April 3rd, London: Our Private Dinner focused on Payouts and Payments hosted together with Marqeta [Reach out to me if you want to join]

- April 9th, Berlin: Our 6th Embedded Finance Review Event during FIBE, sponsored by 13books Capital, Swan and Visa [Register here]

- May 15h, Helsinki: Nordic Fintech Summit - I will be hosting a panel discussion [Register here]

- May 21st, Zurich: Embedded Finance Event hosted by newly founded Swiss Embedded Finance Association [More details]

- June 25th or 26th, Frankfurt: TechQuartier Digital Finance Accelerator - I will be hosting a Masterclass [Apply here]